Learn How To Check Free Cibil Score Online

Cibil score if used as another work for your ‘credit score' which is a 3 digit sore between 300 and 900. CIBIL is the TransUnion CIBIL Limited which is an Indian company which have all your credit information using which they give you a credit score which proves your credit worthiness. Credit score the term tells about your borrowing and repayments of money and such financial transactions. Cibil is India's most trusted company and their credit score is referred to for scoring and ranking an individual as a dependable or a risky borrower. So a Cibil score is basically your financial report card which scores you between 300 and 900, while 700 is a minimum requirement for loans and credit cards.

Why is Cibil Score So Important?

A good credit score is important as it tells about your eligibility as a borrower. This score has a direct impact on how worthy are you for a loan and what is the loan amount you are eligible for and also what should be the interest you are charged. The Cibil score lets the lender judge you and the risk in lending you money. Not just individuals, companies also get a Cibil score which impacts their investments.

How to Check Cibil Score Online: Step by Step Guide

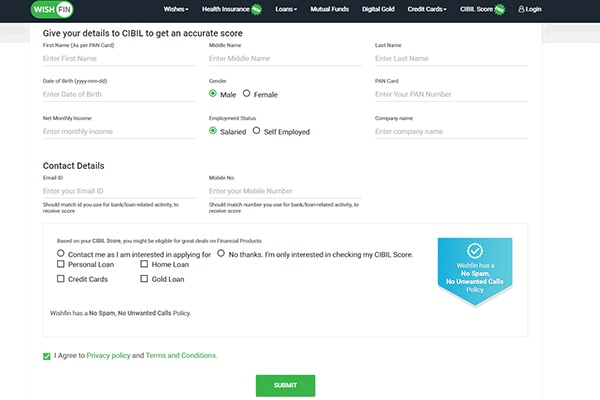

Check Your Cibil Score on Website

Personal details required to check Cibil score

Photo Credit: https://www.wishfin.com/

Checking on your Cibil rating is a simple 2 minute process using the Cibil powered site https://www.wishfin.com/. Wishfin is an official fintech partner of TransUnion CIBIL, Credit Information Bureau of India, which is the official Cibil scoring site.

Step 1: Go to CIBIL score page at https://www.wishfin.com/

Step 2: Enter your personal details it asks for like – Name, Gender, Mobile Number, Address, PAN Number, Monthly Income, Company Name and rest.

Step 3: Now simply click on the Agree to terms and conditions.

Step 4: Click on the submit button to see your Cibil score.

Check Your Cibil Score on WhatsApp

Yes Cibil also gives you an option to check your score using WhatsApp, using this safe and secure way you can be sure of no information leaks and only a quick Cibil score check.

Step 1: Using your phone give a missed call to this number +91-8287151151

Step 2: In a bit you will see your number has been added to the WhatsApp Chat

Step 3: Now write down your personal details like - Name, Gender, Mobile Number, Address, PAN Number, E-Mail ID, Monthly Income, Company Name and more.

Step 4: Soon after you have processed your details you will receive your Cibil score on the same WhatsApp number

Benefits Of Having A Good Cibil Score

A good Cibil score makes the person or company eligible for loans and investments. Loans and credits are offered only after verification of numerous details of an individual which is where the Cibil rating helps. A loan is approved only on the basis of some more important information about the person which aids the decision making like – relationship with the borrower, employment status, age, history and more, while Cibil rating happens to be the most important of them all. Let's look at some of the benefits of having a good Cibil rating.

- Eligibility for loan

- Admittance for the best of the credit cards

- Acceptance for best interest rates

- Better financial opportunities in future

What Factors Affect A Cibil Score

There are some factors which you can keep in check if you are trying to maintain a good Cibil score, these are:

- Income

- Previous loan application rejections

- Existing loans and debts

- Past credit payment status

- Delays, default in your loan payment

Frequently Asked Questions About CIBIL Score

What is a good credit score to apply for a loan?

Having a minimum Cibil score of 700 or 750 can increase your chances of getting a loan.

What's a good score for a home loan?

Having a sore anywhere near 650 can boost your chances of getting a home loan.

How can one maintain a good Cibil score?

You can definitely keep your Cibil score maintained or get better by following these few simple tips:

- Pay your loan EMIs on time

- Pay your credit card bills on time

- Cancel credits cards that are not in use

- Don't re-apply for a loan you got a rejection for earlier

How to check your Cibil score?

You can with simple steps check your Cibil score on https://www.wishfin.com/ by entering your personal details asked for, you can also check your Cibil score using this WhatsApp number - +91-8287151151 and then sharing your basic personal details.

Does repeatedly checking your Cibil score spoil your score eventually?

When checking your own score it is considered a “soft inquiry” but when a lender is checking someone's score it is considered a “hard query” which when done multiple times over a short period of time can demonstrate “credit hungry behaviour” which can hurt your credit score.

Also Read:

How To Check PF Balance

How to Link PAN Card With Aadhaar Card

How to Check Airtel Balance

How to Check BSNL Balance

How to Check Idea Balance